A friend of mine called me recently to ask for help with evaluating an investment opportunity. Someone was asking him to invest in his business and receive a fixed sum as interest every month. He wanted to know what to look out for in determining whether to go through with the investment or not.

With the pandemic putting a lot of strain on our collective pockets, everyone is keen on exploring opportunities to generate additional income. However, it is just as important to look before you leap, to avoid ending up in a worse financial situation than you started out with.

Here are a few due diligence steps that can help reduce the risk of making a bad investment:

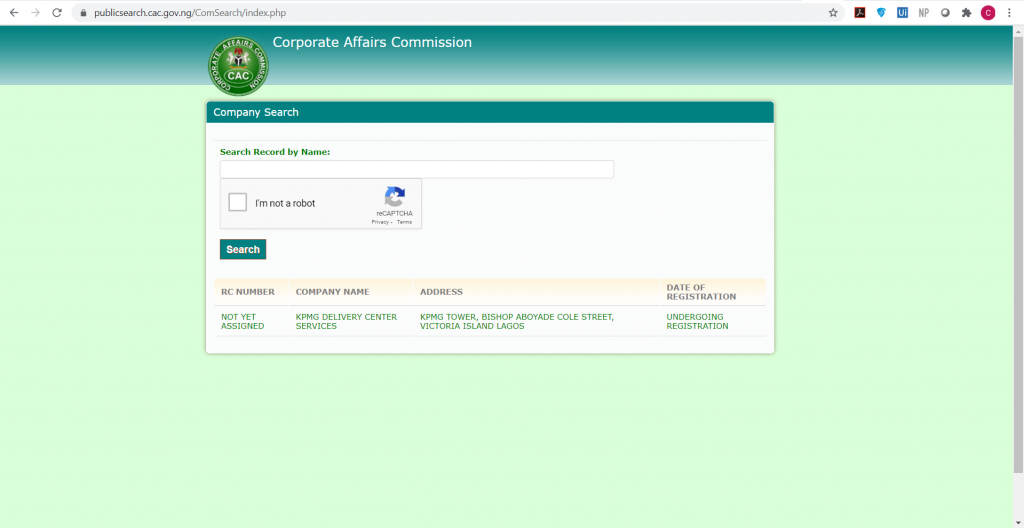

- Make sure you are investing in an actual company that is legally registered. You can check companies registered in Nigeria on the Corporate Affairs Commission (CAC) website in a few short steps:

-

- Go to the CAC website

- Type part or all of the company name in the search box

- Check the box to confirm that you are not a robot

- Click “Search”

If it is a registered company, it would be displayed in the search results, with the RC (registration) number, company name, address and date of registration. You may see multiple results if it is a company with a common name. Confirm that the specific company you are interested in is on the list.

If the company is still undergoing registration with the CAC, it will appear in the search results but with a “Not yet assigned” RC number and a notice of “Undergoing registration” in the registration date column.

- Verify who the owners, board members or principal officers of the company are. A quick way to do this is to check the company website. The “About” section would typically include the names and profiles of the company’s principal officers and/or board members. If you are making a more direct investment (not through an intermediary), you may have access to official documentation such as the company’s CAC forms that contain this information.

Check the reputation of these people. What other ventures are they involved in? Do they have a track record? Are they well established/do they have a respected brand? You want to stay away from people with questionable character or dealings. Also, if you are unable to find any reasonable information on who is behind the company, it may be a good idea to refrain from investing.

- If the company has a physical address, visit the office and speak to the key officers. You can also confirm from neighbours (if possible) that the company has been located there for as long as they claim. This helps establish a level of permanence, which means that they are unlikely to disappear overnight with your funds.

- Understand the nature and business model of the business being invested in. Does it make commercial sense? Is it a viable business model? What will your investment be used for? You do not want to invest in a business that would soon cease to generate income.

To do this, you can look at similar companies in the same industry. How long have they been in business on average? How do they make their money and how sustainable is it? Will they still have demand in the next few years?

If it is a new business, review their business plan and look at their financial projections. Are they realistic considering the economy, the current state of the market, consumer trends, etc?

- Ask to see the previous (audited) financial records of the business. Look out for key performance metrics such as profit margins, cash flow position, any existing debt and proportion of interest payments to revenue/profit. You should probably not invest in a company that has sustained sinking or negative profit margins or an already unhealthy debt to assets ratio.

- Be clear on the terms of the investment. Ensure you have a detailed legal agreement with the investee. At a minimum, your agreement should answer the following questions:

-

- What is the expected tenor (timeline) of the investment?

- How much exactly is the principal to be invested and what is the nature of the investment (equity, loan, etc)?

- When is payout of principal and returns expected?

- What measures are in place to ensure steady payment of returns without default?

- What will be done in case of default?

These steps should help mitigate the risk of entering into a bad investment, but the list is not exhaustive. The information you can access may also vary depending on the type of investment, but always ensure you only invest in what you understand and gather adequate evidence to confirm that the business is legitimate before venturing into it.

Do you have additional tips that can help people evaluating investment opportunities? Share your thoughts and questions in the comments or shoot me an email at hello@chiamakaokoye.com.

Very good read!